|

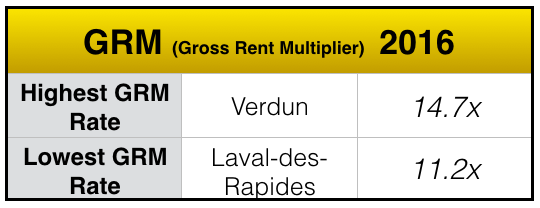

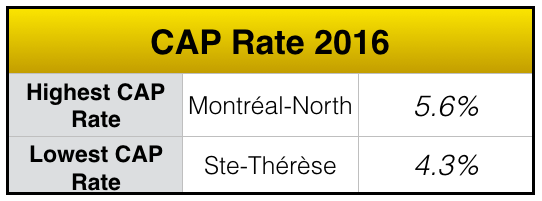

A brief look at 2016 Overall, there were 1,260 transactions completed in 2016, thats up by 15% from 2015. The average price of a plex that sold was approximately $750,000. The vast majority of buyers for these properties came locally from Quebec, with a very insignificant number coming from outside of Quebec. The CAP rate, is averaging out at just under 5% in the Greater Montreal Area. The CAP rate is calculated by dividing the NOI (Net Operating Income) by the purchase price. For more information please dont hesitate to contact me for a meeting. - Serge K.

0 Comments

Real Estate Investing 101: The Basics of Buying a Revenue Property

Many of my clients have seen their investment returns from stocks and the banks diminish over the last year and are curious about putting their money into real estate as an investment to grow their wealth. Here’s a very basic primer on what to look for and what to avoid if you are thinking about investing in a revenue property. Don’t take a chance with your revenue property purchase in Montreal, know the basics before starting your property search. If you’re at the start of investigating how to invest in a Montreal area revenue property, read on to learn the basics. Learn to Leverage Investing in real estate is different from investing in the stock market. Stocks cannot be leveraged, meaning you buy with the money you have available, whereas with real estate you can leverage the bank’s money on the form of a mortgage. However the entry-point for typical real estate investing requires more cash on the part of the investor, and the cost to buy or sell real estate involves much higher costs (inspections, broker, notary, etc.). Also the cost to maintain a stock portfolio is limited while owning a property requires both time and money. However for those savvy investors who have put their money in well-located, well-run, profitable revenue properties, they have done very well for themselves financially over the past 10 years. Many of my clients have built very substantial portfolios of properties since the time I have worked with them and some have even managed to become financially independent since getting started in real estate investing. When most people think of a revenue property they think of a duplex or multi-plex building that has multiple apartments that will be rented out to tenants, but this is only one type of revenue property. A property that generates revenue for the owner can also be a single-family home, a condo, a summer cottage or even a vacation property. We will not touch on commercial or industrial properties although the concepts are similar. Collect Rent Besides the quality and location of the property, the most important factors to look for is whether the property will indeed generate sufficient revenue to cover your costs of ownership in the form of rent and whether the return you are getting on your investment is worth the extra time and money to maintain and manage. The idea is that you can buy a property, leverage the bank’s money in the form of a mortgage and get back monthly payments (ie rent), which we call cash flow. Cash Flow is King On a very basic level cash flow can be understood as the cash that will flow back to the owner of a revenue property after all the expenses, taxes and mortgage are paid. As a simple calculation: You buy a property that generates $50,000 in rents every year. You have to pay for heating of common areas, cleaning and some electricity and that costs you $7,000 a year, and you have another $5000 in taxes to pay. $50,000 – ($7,000 + $5,000) = $38,000. Now let’s say your mortgage payments for the year come out to $15,000. $38,000 – $15,000 = $23,000, which would be your net annual cash flow, the amount of money that comes back to you after all operating expenses, taxes and debts are paid for. It’s the foundation for all other decisions that need to be made when buying a property. Either it cash flows or has the potential to, or it doesn’t, in which case you need to evaluate whether you should buy it or not. Either it cash flows or has the potential to, or it doesn’t, in which case you need to evaluate whether you should buy it or not. One huge mistake I see a lot of novice investors making is buying into revenue properties that do not generate enough income to cover the costs of owning it. Meaning, they buy with the idea they will pay out of pocket every month to “hold” the property and will be at a net loss every month just to own it. There are several “investment promoters” around Montreal who push these types of under-performing investment condos on unknowing investors, with the idea that they property will appreciate in value and so there is no need for the property to cash flow for the owner. Incredibly they sell the idea that this is a good way for wealthy investors to “show a loss” on their income tax. Before you buy a revenue property, make sure it generates enough of these. While that may be true for large investors or in very particular cases, and the property may go up in value over time, but would you ever put your money in a bank that said “We are going to take 10% of your money every month, you have to physically manage your bank account yourself BUT you might get more back when you decide to withdraw your money… or you might not!” At that point you are gambling, not investing. The numbers of small investor clients I meet who have been disappointed by these types of “investments” is astonishing. The same types of investment schemes are often offered to buyers of vacation properties. If it doesn’t cash flow and you are not receiving a return on your investment, I would generally avoid it unless you indeed want to not just “show a loss” but “experience a loss” of your money If it doesn’t cash flow and you are not receiving a return on your investment, I would generally avoid it unless you indeed want to not just “show a loss” but “experience a loss” of your money. If a property isn’t making money for you, what investor is going to buy it from you, when you try to sell; who wants a property that is losing money? A good real estate broker experienced in revenue properties can advise you on whether a given property should cash flow for you or not. A Revenue Property to Live In However this doesn’t mean that as a starting investor you should only look at cash flow positive properties, many investors began by buying their first duplex where they lived in and rented out the other unit to help cover all or some of the costs. While the owner lives there he is getting the benefit of living in the building, so it shouldn’t be expected to cash flow as well. The same can be said of vacation properties, if you are going to be spending your holidays there, then you are getting the benefit of enjoyment, so it may not be as important to make money from it. Look at the Fundamentals As a general rule, look for properties with good underlying fundamentals, structurally sound, in good accessible locations, near services, near transport, in areas that are growing, with heating and electricity paid by the tenants. The property may not be cash flowing currently, but it may cash flow nicely after renovations and improvements. …do the due diligence that is required before taking on a substantial investment such as a revenue property. Be aware of market rents and vacancy rates (your broker can provide you with these statistics), and don’t buy just because the price seems low and within your budget. Look at major renovations that are or will be required, and keep your calculator handy, to ensure the property will still make money for you throughout the time you own it. In other words, with your broker, do the due diligence that is required before taking on a substantial investment such as a revenue property. We’ve barely scratched the surface of the most basic concept of cash flow, there is so much more involved with investing in real estate and many other ways people can get involved with real estate investing without requiring huge amounts of cash to do so. Here are 10 features that investors should evaluate and consider when hunting for that perfect real estate investment property.

1. Employment Opportunities: Locations with a growing job market tend to attract more people. More people means more renters, especially if you target an area with a large rent/own ration. You can visit Statistics Canada for reliable and timely data on the labour market for the area you are considering. If you notice a large corporation moving to the area, migration will follow. College towns are now also a viable option as there is the steady flow of students needing off-campus housing, although the demand may only be strong for the September to April school year. 2. Location, Location, Location: The quality of the location will influence the type of renters attracted to your rental property. Look at criteria, such as the Walk Score, proximity to transportation, hospitals, proximity to universities and colleges, major business centres, local restaurants and shopping. The more central the location, the greater the demand. 3. Rent: For income properties, your monthly rent is your staple. Find out what the average rental rates are in the area. Can you achieve above or below the average? At the very least, you are going to want to cover your mortgage payment, taxes and miscellaneous expenses like insurance. If this can be achieved, then you can move on. 4. Safety: No one wants to live in an unsafe neighbourhood. You can inquire about crime rates. Again, Statistics Canada is a great resource, and even the local police department can tell you whether the neighbourhood is safe and secure. 5. Amenities: What attractions are nearby that will both be a draw and requirement for renters? Things that must be considered are shopping malls, parks, movie theatres, gyms and access to public transportation. 6. Schools: One of the top considerations for your renters may hinge on the school district and specific schools that they want their children attend. Researching the local schools will be a key variable which can increase your renter pool as well as significantly impact the overall appreciation of your investment property. 7. Future Development: What developments are planned for the area which would positively or negatively impact the value of your investment property? Is it a high-growth area or one that is currently in decline? A neighbourhood in the early stages of gentrification might result in a faster and higher appreciation for your investment property. 8. Inventory: Is there a lot of inventory available on the market? Make sure you look at market trends for the last few years as you don’t want to be in a seasonal trend only when making your investment decision. You have to review the vacancy rates that have existed based on inventory levels and how this may impact your monthly rental rates. 9. Property Taxes: These costs affect your bottom line. Review the taxes and the current market value assessments and determine if they are high, and if so, whether there’s a reason. 10. Insurance: These are additional costs that erode your bottom line returns. Of course, you don’t want to invest in areas where you cannot get insurance, like flood plains or possible proximity to natural disasters. You can do your research with your insurance agent to determine the risks of claims that might exist and if you can get coverage at all. The easiest and possibly best investment properties for beginners are residential single family homes and condominiums. Condos are low maintenance, as generally the condo corporation is responsible for external repairs. You must keep an eye out for high maintenance fees which are generally charged on a cost per square foot per month basis. Do your research and comparative analysis to ensure these costs are in line for the building in question. When you have the type of property you desire and the neighbourhood narrowed down, look for the best properties that have both appreciation potential and good projected cash flow. You should choose an experienced and seasoned realtor who has a proven track record of helping buyers with the acquisition of investment properties. You’ll want a successful realtor to help and advise you with this exciting opportunity! The tax implications of switching a rental property into a principal residence and reporting obligations after a home sale were among the topics raised in the latest batch of reader letters. Here’s what they wanted to know.

Q: “I bought a home in 2011. It was my principal residence until 2014, when I rented it out and purchased another residence. I intend to move back to my original house in 2017. It hasn’t really appreciated much since 2014. Am I supposed to report this to anyone? Will it require an evaluation?” A: Probably not. Just keep your municipal tax slips. The federal and provincial tax departments likely would accept the municipal evaluation of the property for the years in question as sufficient proof of value. Because you’re changing the use of the property (from rental to principal residence), you are supposed to report the change to both the federal and provincial tax departments. (You were also supposed to report it when you did the prior switch in 2014). If you didn’t claim capital-cost allowance on the property during the time you rented it, you won’t be obliged to pay any capital-gains taxes now for the brief period you rented it. You can make an election with CRA to postpone any tax until you actually sell the property. An election with CRA would automatically apply for Quebec tax purposes as well, but Revenue Quebec will want a copy of what you send CRA for its files. If CCA was claimed, however, you’ll have to cough up for the 2017 tax year. Q: “You recently reported that the federal government will require homeowners to report sales of a principal residence to the tax department in 2016 and beyond. You also said Quebec already had this measure in place. Are Quebec residents obligated to report home sales even if it was their principal residence?” A: It’s been in the provincial tax code for a while. When Quebecers sell a property, transfer ownership to someone else or convert it into or from an income-producing property, they’re supposed to complete provincial tax form TP-274-V (Designation of a Principal Residence) and include it with their provincial tax return in the year of the transaction. Quebec says failure to do so may lead to “all or a portion” of any profit being treated as a taxable capital gain. Q: “I made an emergency withdrawal from my RRSP this year and was shocked by the fees charged: administration fee, GST, withholding tax. I didn’t expect all of this. Can I deduct these fees from my taxes?” A: The withholding tax is actually income tax, and you’ll be credited for the amount paid when you get a slip (T4RSP) from your financial institution to include with your 2016 tax returns. (For Quebecers, the withholding tax is 21 per cent on RRSP withdrawals up to $5,000, 26 per cent for amounts between $5,000 and $15,000 and 31 per cent on $15,000 or more). The bad news is, the actual amount of taxes owed may be higher than the amount withheld. Ultimately, it will depend on your total 2016 income (which will include the RRSP withdrawal). You could end up owing more than they took off. As for the other fees, they’re not tax-deductible. All the more reason to keep RRSP withdrawals to a minimum. |